Asset-Backed ProductsCover countless tokenization use cases with the Rudiq engine.

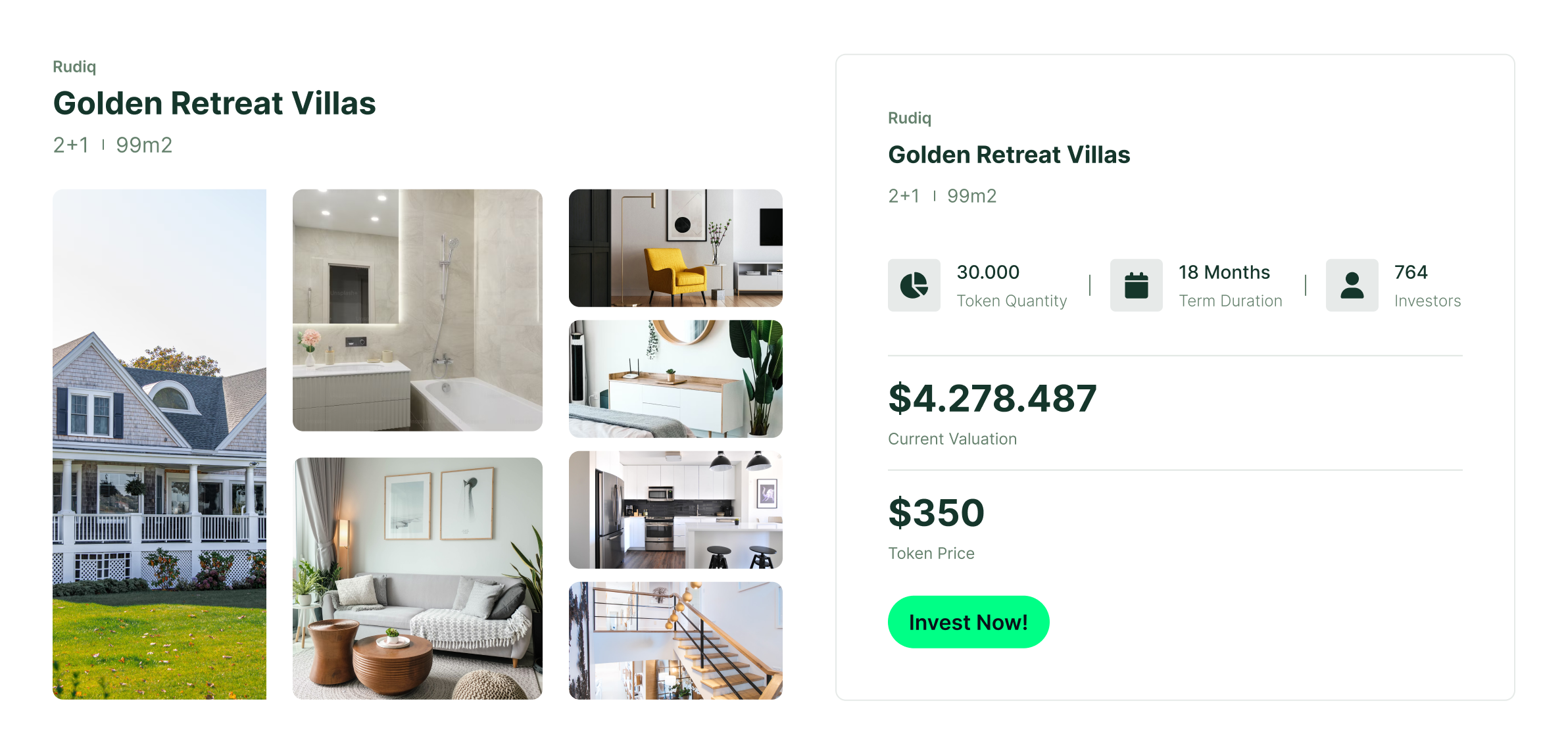

Real Estate

Assets such as residential, commercial, and agricultural properties for fractionalized invesment.

Ship

Refers to maritime vessels such as passenger ships, cargo ships, and yachts used for transportation, trade, or leisure.

Commercial Properties

Includes shopping centers, hotels, and industrial facilities used for business purposes and generating revenue.

Industrial Assets

Comprises factories, warehouses, and logistics centers used for production, storage, and distribution in various industries.

Energy Plants

Consists of facilities that generate energy from renewable or conventional sources.

Bonds and Notes

Fixed-income securities like government bonds, convertible bonds, and green bonds that provide regular interest payments and are repayable upon maturity.

Sukuk (Islamic Bonds)

Sharia-compliant financial certificates that function similarly to bonds but adhere to Islamic finance principles.

Investment Funds

Pooled investment vehicles that allow investors to hold a diversified portfolio

ETF

Investment funds traded on stock exchanges that track various indexes, commodities, or sectors.

Venture Capital Funds

Private equity funds that invest in early-stage or high-growth startups.

Real Estate Investment Funds

Funds that invest in real estate properties and generate income through rentals, leasing, or property appreciation.

Equity and Private Equity Instruments Equity Stocks

Ownership shares in a company that entitle the holder to a portion of the company’s profits and voting rights.

Start-up Private Equity

Investment in early-stage private companies, offering potential for high returns as the business grows and succeeds.

Crowdfunding

A method of raising funds from a large number of people for a variety of projects, businesses, or investments.

Precious Metals

Includes valuable metals like gold, silver, and platinum, commonly used as safe-haven investments.

Energy

Includes key resources such as oil, natural gas, and renewable energy sources, vital for global economies.

Agricultural Products

Refers to natural resources that are traded in commodity markets and are essential for global supply chains.

Industrial Metals

Metals that are fundamental to industrial manufacturing processes and construction.

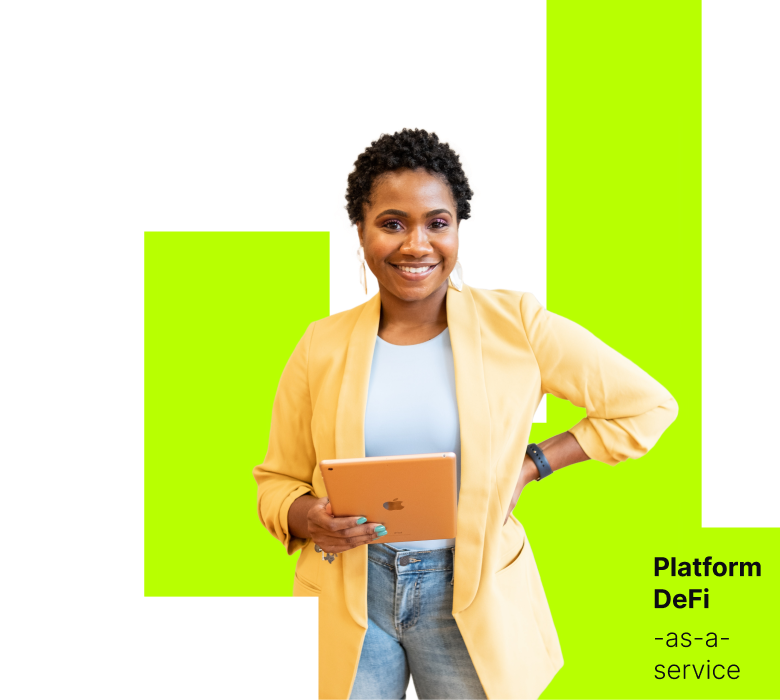

Public

Offering Tools

Offer your tokenized RWAs to your customers with a customizable value proposition based on asset type and preferences, such as maturity date, income distribution, and more. Operate your tokenization value chain with a launchpad and revenue-sharing model.

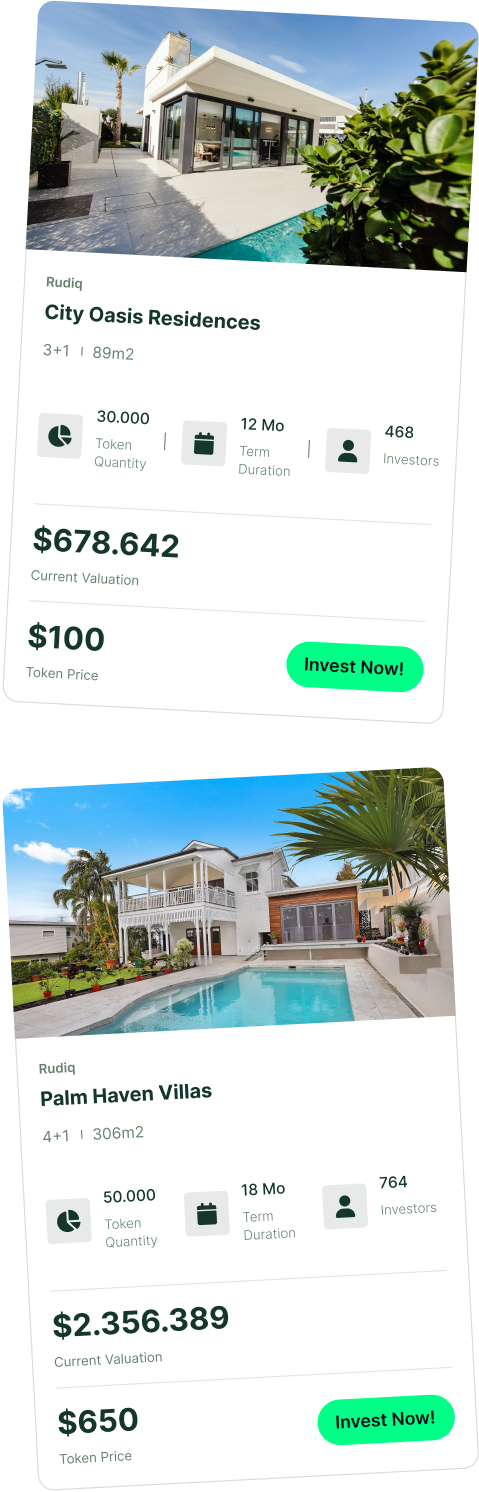

Offer Tokenized Assets

- Define the terms of your tokenized offering, as each asset type comes with different conditions and logic.

- List it on your platform’s launchpad.

- Enable new investment opportunities for your customers and create a new liquidity channel for your business.

Distrubute Income

- Distribute income from tokenized assets to your investors.

- Create incentives for purchasing additional tokenized assets.

- Enable mutual benefits for both your customers and your business.

Lending

Infrastructure

Allow tokenized assets or existing crypto assets to be used as collateral for lending operations. Classify each asset to customize liquidation mechanisms and marketplaces as security measures, ensuring your business remains safe even in volatile markets.

Asset

Classification

- Automatically allowlist and classify each asset based on market metrics, or manually according to your business preferences.

- Customize the terms for each class, such as loan-to-value, liquidation threshold, and more.

Borrowing &

Lending

- Enable tokenized or existing crypto assets to be used as collateral for customer borrowing.

- Lend those assets based on your preferred interest return.

Liquidation

Mechanism

- Keep your business safe during market volatility with liquidation supported by arbitrage.

- Operate a liquidation marketplace to offer assets to your customers at a discount.